At Baloise, you sign all the documents required to open a bank account in a single action

Baloise streamlines the process of creating a bank account and makes it even more secure. Customers can now sign all required documents at once from the comfort of their own home with a single action. Depending on the type and number of opened accounts, this can quickly add up to five to ten documents. Baloise isn’t just digitalising on the customer side – but all the background processes, too. Thomas Maurer, Head of Customer Service Bank, goes into the details.

How Baloise found Skribble

Mister Maurer, Baloise has been using another provider’s e-signature for some time now. Why do you use Skribble for opening a bank account online?

The existing e-signature solution works well where it is already in use – for setting up a new customer or product with a Baloise employee. This process was unsuitable for expanding to other business processes – too much project and programming work would be required. Baloise was looking for a provider that was renowned on the market and would enable all employees to sign any type of document electronically in an instant – without the efforts involved in integration. The search ended with the decision to opt for Skribble.

Were there any other reasons for choosing Skribble?

Yes, in addition to high flexibility and universal applicability, the solution should:

- Be cloud-ready

- Available for use in five minutes and without an IT project

- Cover the advanced (AES) and qualified electronic signatures (QES) at a minimum

- Offer QES in accordance with Swiss (ZertES) and EU law (eIDAS)

- Enable integration via API into new and existing processes in order to benefit from economies of scale*

- etc.

*Economies of scale: Describe how increasing production or purchased quantity can reduce unit costs and thus increase profit.

I assume you’ve also looked at other providers?

Yes. Baloise also shortlisted two other providers alongside Skribble.

Thomas Maurer, Head of Customer Service Bank, BaloiseBaloise also shortlisted two other providers alongside Skribble. Skribble was the only one to meet most of the requirements ‘out-of-the-box’. Skribble was a pleasant, skilled and honest partner to interact with at all times. The servers being located in Switzerland was also important to us.

How Skribble is used today

How did Baloise introduce Skribble?

After a successful pilot within the bank, Skribble 2021 was made available to all employees in Switzerland via browser. This also meant that the enormous challenge of working from home was removed – anyone could sign any document immediately from anywhere. Today, we use Skribble’s e-signature internally and externally for a wide range of applications – including HR employment contracts and certificates, for opening business accounts and for pension agreements with existing clients. Or for the new account opening process for new customers online (self-onboarding).

What are the benefits of opening a new account online for your customers?

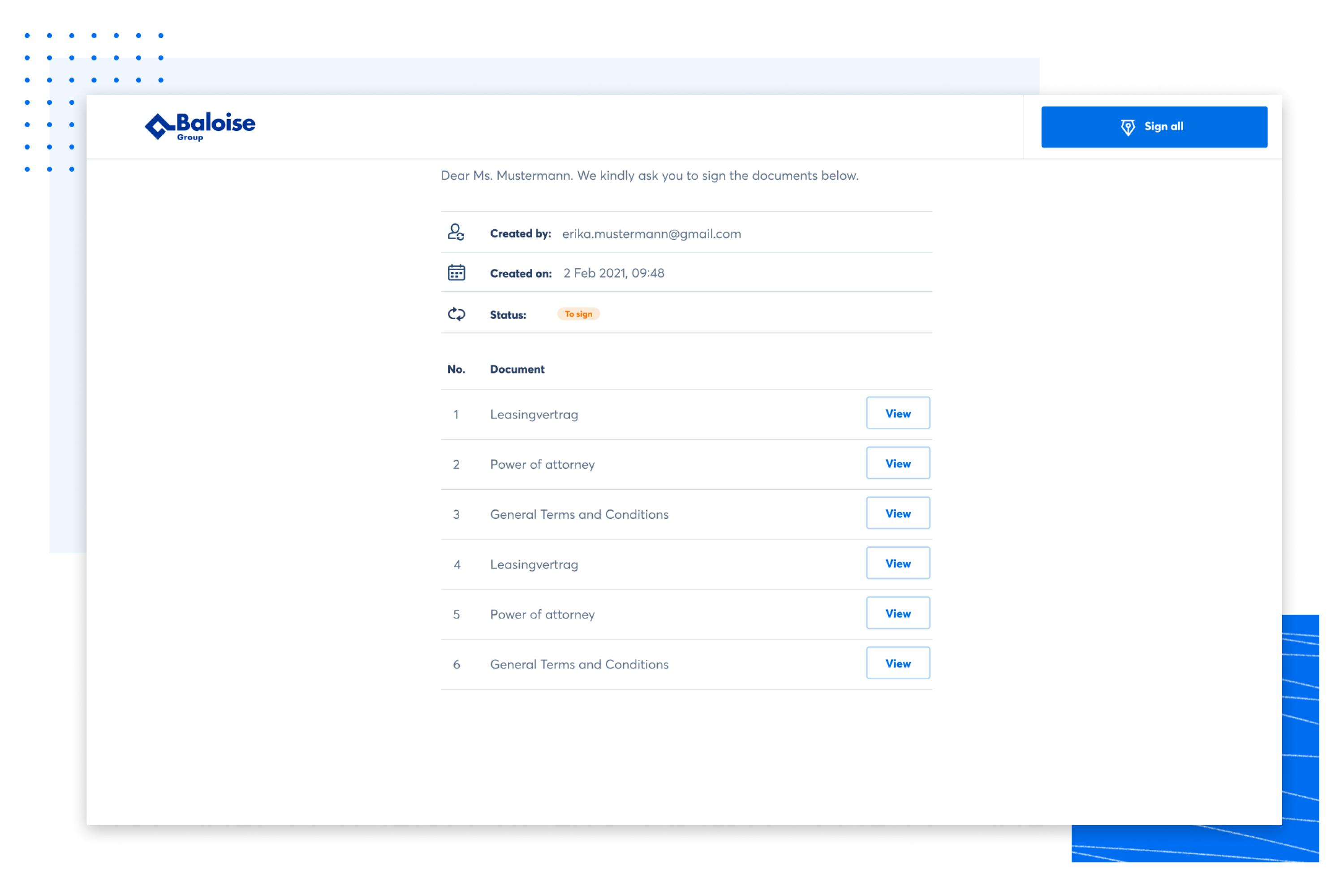

Digital customer setup saves time, most of all. What’s new is that customers can sign up without an adviser – and they can do so from anywhere. In addition, customers can now sign multiple documents with a single action – depending on the type and number of opened accounts, it can quickly be as many as five to ten documents that we are unable to combine into a single PDF for efficient processing and archiving.

Thomas Maurer, Head of Customer Service Bank, BaloiseThanks to Skribble’s batch signature, our customers can sign all the required documents with a single action. This saves us a lengthy paperwork process and offers ourselves and the customer enormous added value, as the account setup process is much faster and more secure.

Watch the screencast here to see how easy it is to open an account with Baloise (German only)

In brief: The batch signature allows multiple documents to be signed at once. The signer signs all documents with a single confirmation on their mobile phone. Each individual document in the batch will then receive a certificate with the e-signature standard used (EES, AES or QES).

But you need to identify your new customers with proof of ID. How does Baloise manage this via the internet?

Exactly. The Anti-Money Laundering Act stipulates, among others, that identity must be checked using proof of ID. For banks, signature and identification are two different things that we must consider separately at first. This often leads to misunderstandings. The trick is to combine these similar, but different, legal bases in such a way that the customer can benefit from a single-source service.

Can you expand on that a bit? So identity checks for new customers of a bank have nothing to do with the identification that allows people to sign with QES?

No. The two processes have different legal bases. Banks and, depending on transactions, insurance companies must check their customers’ identity in line with specific requirements in order to minimise the risk of money laundering. This can be done without a signature, too.

Thomas Maurer, Head of Customer Service Bank, BaloiseFrom a banking perspective, identifying new customers has nothing to do with signatures. This process is based in particular on FINMA Circular 2016/7. This has enabled video and online identification for financial intermediaries for several years now.

Note: The identification process for a qualified electronic signature in Switzerland complies with the Swiss Signature Act (ZertES) and, since spring 2022, may take place by means of self identification or video identification outside of the finance sector.

What the Skribble e-signature does

What are the benefits of Skribble’s e-signature for Baloise?

E-signature allows us to turn processes around more quickly and securely than on paper. Not every individual employee notices, but overall we save a huge amount of time and money. Transport routes disappear and legal certainty even increases because the original document, now in electronic form, is stored in the audit-proof records without being altered or destroyed.

Are there any other improvements that you haven’t mentioned yet?

Yes. For independent customer and product set-up, we didn’t just want to digitalise the process on the customer side – we also wanted to take the opportunity to clean up the hidden processes in the background. In this way, the data collected directly generates the actual account setup in our core banking system.

Thomas Maurer, Head of Customer Service Bank, BaloiseThe signed PDF documents are automatically stored in the bank’s records and the copy of the ID is stored in an identity database. There’s no need for manual data collection.

Which e-signature standard is used most frequently at Baloise?

We set the advanced e-signature (AES) as the standard. The "AES for Business" service made the company-wide rollout much easier – all employees were able to sign in one go. Depending on the application and department, however, we may also use a simple and qualified e-signature – for credit card applications, for instance, or "important" contracts between Baloise and third parties.

in brief: "AES für Business" is a Skribble service that allows a company to identify all employees for the advanced electronic signature (AES) at once.

Are there further digitalisation steps with the e-signature in the pipeline?

For sure. I can think of two use cases in particular:

- Health questionnaire: The aim is to simplify the collection of information on health, for example in the case of high insurance payments. Our tool "EasyAsk" was recently linked to Skribble, which should allow us to provide a legally compliant signature in addition to reducing complexity. The first tests are scheduled to start this year.

- Self identification: We also want to replace identification via live video calls with self identification by the end of the year. Instead of having a live chat with a customer adviser, new customers record and upload a video of themselves, which is then checked by an identification partner at a later date. This makes onboarding more attractive overall. Arrangements are currently being made.

About Thomas Maurer

Thomas Maurer is Head of Customer Services Bank at Baloise. He was responsible for the launch and pilot of Skribble and later advised the entire group with his e-signature expertise. Baloise subsequently introduced Skribble across the group and now uses its e-signature for a wide range of applications both internally and externally. This includes "self onboarding" of new bank customers.

About the Baloise Group

Based in Basel, the Baloise Group is a provider of prevention, pension, assistance and insurance solutions. Its core markets are Switzerland, Germany, Belgium and Luxembourg. The Group employs 7,900 people.

In Switzerland, Baloise operates as a focused financial services provider, bringing together banking and insurance. Baloise provides its innovative pension products for private clients throughout Europe from its centre of excellence in Luxembourg. In recent years, Baloise has also welcomed a number of start-ups into the family, including MOBLY in Belgium, FRIDAY in Germany and MOVU in Switzerland.